Managing finances should be simple, secure, and accessible from anywhere. Understanding this, BRI Global Financial Services has created remit.go! – a comprehensive mobile app designed to transform the way you handle financial transactions. Whether you’re looking to save, send money, open a new account, or check your balance, remit.go! brings all these essential banking services right to your fingertips.

remit.go! empowers you with this features:

Save and Send Money in Easeremit.go! is built to meet the needs of users who want to both manage their savings and send money to loved ones effortlessly. With a user-friendly interface, remit.go! enables you to save securely while giving you the flexibility to send funds instantly. This feature is ideal for those who regularly support family members in Indonesia or wish to keep a financial cushion within reach. Additionally, remit.go! UI helps to ensure whether you are new to mobile banking or an experienced user, sending and saving money will be efficient with the remit.go! benefit which have a partnership with 7-Eleven to cash-in your money anytime.

By reducing the complexity often associated with financial transactions, remit.go! gives users the freedom to control their finances with confidence. With the app available 24/7, you can manage your money whenever and wherever you need it, breaking down the barriers of traditional banking.

Instant Access to Your Savings InformationFinancial awareness is crucial to making informed decisions. remit.go! offers a Cek Tabungan feature that allows you to monitor your savings balance in real time, anytime you open the app. No more wondering about your current balance – remit.go! provides instant access to your account, helping you stay on top of your finances at all times.

This feature is particularly helpful for users who are balancing various financial responsibilities. With just a few taps, you can verify your balance before making a transaction or setting aside savings, giving you full transparency and control over your funds.

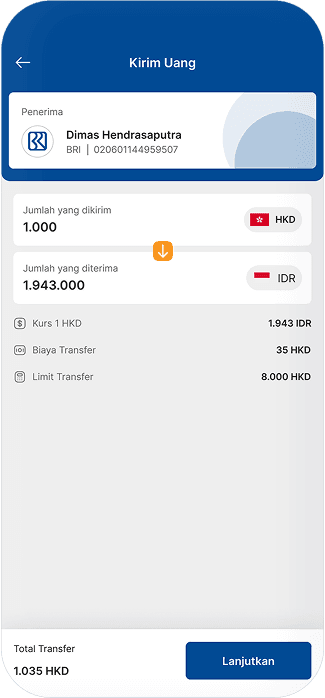

Fast and Secure Fund Transfer Across IndonesiaIn general, sending money back to your home country is important for you and your family. By using remit.go!, it will not only offer you speed and convenience of a transaction but also a peace of mind. Now, you can support your family conveniently, knowing that your transactions are safe and reliable.

Whether it’s a one-time or a regular transfer, remit.go! ensures that your money gets to its destination quickly and securely. The Fund Transfer feature within the app is designed to simplify the process, allowing users to send funds to any bank accounts across Indonesia in real time. The app’s security protocols ensure that every transfer is encrypted and protected, keeping your information safe from start to finish.

Open a New BRI Saving AccountOpening a bank account has ever been easier. With remit.go!, you can open a new BRI account directly from your phone without the need to visit a branch. This feature makes banking more accessible for those who might not be able to reach a physical location, offering a fully digital, hassle-free solution to open an account.

Buka Rekening feature empowers users to begin their banking journey in minutes, paving the way for financial inclusion and convenience. Whether you are a new customer or an existing one looking to open another account, remit.go! makes the process simple and streamlined.

Why Choose remit.go!?remit.go! stands out as more than just a banking app – it’s your financial companion, designed to meet the demands of a fast-paced life. With this all-in-one solution, you’re empowered to handle transactions on your own terms, from anywhere, at any time. From its accessible interface to the security embedded in every feature, remit.go! represents BRI’s commitment to innovation, customer convenience, and financial security.

As you navigate your financial journey, remit.go! is there to simplify, support, and secure every transaction. It’s not just an app – it’s the future of banking, making financial management more accessible for everyone.

Subsidiary of PT Bank Rakyat Indonesia (Persero) Tbk

Our Contact

BRI Global Financial Services Co. Ltd.

contact@brifins.com

Head Office Address

Room 1202, 12/F, Park Avenue Tower

5 Moreton Terrace, Causeway Bay, Hong Kong

Head Office Contact

(852) 3590 2875

Main Branch Address

Shop 3, G/F, Bayview Mansion Shopping Arcade,

33 Moreton Terrace, Causeway Bay, Hong Kong

Main Branch Contact

(852) 2890 2709